Once you’ve determined how much income you’ll need in retirement, the next step is to figure out how much you’ll need to have saved up by retirement. Don’t worry. I’m not going to make you do complicated math. If you can multiply, you can figure this out. First, we need to determine how long you’ll be retired.

How Long Are You Going to Live?

Let’s pull out your crystal ball and figure out how old you’ll be when you die. If you don’t have one, then you’re already aware that we’re only estimating here. There’s no way to know for certain when you’ll take your last breath, but you can plan by taking your health and family history into consideration.

You can use the free life expectancy calculator over at Living to 100 to estimate how long you’ll live. You’ll even get some tips on changes you can make to live a healthier, longer life. If you’re married, use the longer life expectancy between the two of you.

How Many Years Will You Spend in Retirement?

Once you’ve estimated your life expectancy, all you need to do is subtract your retirement age from your life expectancy. If you expect to live to age 90 and you want to retire at age 65, you’ll spend 25 years in retirement. Remember that number. You’ll need it in the next step.

How Much Will You Need to Have Saved by Retirement?

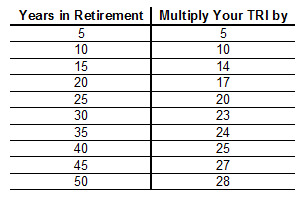

Now for that multiplication I warned you about before. First, you need to know your target retirement income (TRI) from Part 1. Then, using the table below, figure out what number you should multiply by to determine your target retirement savings (TRS). For example, if you’ve determined you need $40,000/year (your TRI) and you’ll be in retirement for 25 years, just multiply by 20 to determine your target retirement savings. In this case, $40,000 x 20 would mean you need to have $800,000 (in today’s dollars) saved by the time you want to retire.

As I mentioned before, using this chart will tell you how much you need to have saved by retirement in today’s dollars. This isn’t the actual number of dollars you’ll need to have in your account because of inflation, but that doesn’t matter. If you continue to use this process once a year, you can be sure you’re saving enough. Make sure you write down your TRS number. You’ll need it for Part 3 so you can figure out how much you should save each year until retirement.

How Much Have You Already Saved?

You’ll also need to know how much you’ve already saved up before you can determine how much you should be saving every year for retirement. This is also the part where we’ll account for your taxes. Because we don’t know exactly what changes will happen to the tax structure, we’ll have to estimate this as well. Here’s how to add up each of your accounts (taking taxes into consideration):

- Tax-free Accounts – If you have a Roth IRA or Roth 401(k), you don’t need to worry about taxes. You can include the full value of these accounts in calculating your current retirement savings.

- Tax-deferred Accounts – Withdrawals from a Traditional IRA, 401(k), 403(b), 457, or similar accounts will be taxed in retirement. For our purposes, you’ll need to account for the taxes you’ll pay on these accounts. Given our current tax structure, you can plan on paying about 20-25% in federal and state income taxes on these accounts. To figure out how much you should include when adding up your savings, use 75-80% of the account value. If you have $100,000 in your Traditional IRA, you should only use $75,000-80,000 when you’re adding up your savings.

- Taxable Accounts – This category includes all your taxable accounts you’re using to save for retirement. It’s a little more difficult to account for taxes in these accounts. You’ll be taxed only on the gain in these accounts. How much of your withdrawals will be taxed depends on your cost basis in these accounts. We’ll estimate that taxes will be about 15-20% on these accounts. So you’ll want to use 80-85% of the account value when adding up your savings.

Here’s a quick example. Let’s say you have $25,000 saved in a Roth IRA, $20,000 in your 401(k) at work, and no taxable accounts. You’ll include the full $25,000 in the Roth IRA and 75% of your 401(k), or $15,000. This gives you a total savings of $40,000.

After you’ve figured out how much you’ve saved, you need to determine how much that is as a percentage of your TRS. In the example above, we determined you’d need $800,000 to retire. If you’ve saved $40,000 already, you’ve saved up 5% of your target retirement savings (TRS). (That is, $40,000/$800,000 is 0.05 or 5%.)

To figure out how much you’ll need to save every year, you need to know your target retirement savings (TRS) and how much you’ve saved already as a percentage of your TRS. In Part 3, we’ll continue to use the example above with a TRS of $800,000 and having 5% of that number already saved up.

Here’s a quick recap of what you’ve done already:

- 1. Figure out how much income you’ll need in retirement (your TRI).

- 2. Figure out how many years you’ll spend in retirement.

- 3. Multiply your TRI by the appropriate number from the chart above to determine how much you’ll need to have saved for retirement (your target retirement savings or TRS).

- 4. Add up your current savings after accounting for taxes. Then figure out how much that number is as a percentage of your TRS (divide current savings by your TRS).

In our working example, we decided we need $40,000/year in retirement. We also figure we’ll spend 25 years in retirement. Then, we multiplied our TRI ($40,000) by the number in the chart for 25 years in retirement, which was 20. That gave us a target retirement savings (TRS) of $800,000. Finally, we figured out we have saved up $40,000, or 5% of our TRS, after accounting for taxes.

To make sure you know what to do next, sign up for free updates to Provident Planning!

Hi, you forgot to account inflation into your hypothetical TRI when it is extremely important. Someone with 40k in their accounts is usually someone in their 20s or 30s which means it takes them 25-40 years before they reach retirement date.

You mentioned that this person “determined” they will need $40k during their retirement. $40k in 35 years equals to $14k in today’s dollar assuming 3% inflation. How many people you know TODAY who lives on $14k a year?

This number is a rude awakening. I thought I would only need around $30k when I reach 60, which is in 32 years (and I thought it was a modest number). But that number is in today’s dollar. With 4% inflation over 32 years, that $30k balloons to $107,000. So that means I will need over $2.5 million in my nest egg which is more than twice my initial estimation. Wow!

TRI is more crucial than people realise and most articles I read in retirement subject only “guesstimate” the numbers when it is actually what distinguish between eating baked beans and having fulfilling retirement. Just think about this; how many people 30 years ago thought that they would need about $40k/year (or more?) to live comfortably today?

Hi, Bytta! Thanks for your comment.

Actually, I did not ask people to factor inflation into their number because it is handled in the calculator I created, which you can find here. It’s easier for people to think in terms of today’s dollars, and my goal was to keep this as simple as possible. However, I fully account for inflation in the free retirement calculator I created. It’s just handled behind the scenes. If you’re interested, it assumes a 3.5% rate of inflation.

Trust me, I would not forget to include inflation in such an important calculation. I’m as adamant about its importance as you are. But I also did not want to complicate things for the average person either. If you follow the steps in my article with the free retirement calculator, inflation will be handled for you. Thanks again for your comment!