There are thousands and thousands of people out there living lives of quiet, screaming desperation who work long, hard hours, at jobs they hate, to enable them to buy things they don’t need to impress people they don’t like.

– Nigel Marsh

Archives For Psychology

I’ve been thinking a lot lately about a Christian’s proper relationship to material wealth – especially in terms of what’s appropriate for us to desire and what’s not. The difficulty comes in trying to draw lines. When do our desires become excessive? How do we know when we’re pursuing the things of this world above the kingdom of God? Where does ambition stop and greed begin?

I’ve been thinking a lot lately about a Christian’s proper relationship to material wealth – especially in terms of what’s appropriate for us to desire and what’s not. The difficulty comes in trying to draw lines. When do our desires become excessive? How do we know when we’re pursuing the things of this world above the kingdom of God? Where does ambition stop and greed begin?

Greed – that’s what I want to talk about today. But not so much talk about as discuss with you. What I want to know is how you define greed. What is greed? How do you know when you’re being greedy? How can Christians protect themselves from becoming greedy?

Let’s look at a few definitions of greed, and then I’ll show you why I think it’s such an important concept to understand. The Bible says quite a bit about those who are greedy, and it’s not good…

Definitions of Greed

Dictionary.com states that greed is “excessive or rapacious desire, especially for wealth or possessions”. In other words, greed is when you’d extort, rip off, and even steal to get more money. Obviously, that would violate Scripture and Jesus’ command to love our neighbors.

On the other hand, WordNet, a project at Princeton University, defines greed as an “excessive desire to acquire or possess more (especially more material wealth) than one needs or deserves”. That’s a much more difficult definition to wrestle with, isn’t it? Where do we set our level of “need” or of what we “deserve”? And when does a desire to acquire more than that level become “excessive”?

I’ve talked before about needs versus wants. We act like many things are needs when they’re actually just wants. Our needs are very few: food and water, clothing, and shelter and warmth depending on your local climate. In the strictest sense, that’s all we truly need.

And within each of those categories there’s a level beyond which the need becomes a want. We only need food that’s edible and enough to keep us going. We only need clean water. We only need enough shelter and warmth to protect us from the elements and provide a place to rest. And even that one is debatable to some extent.

I don’t say these things to make myself or you feel greedy if we want anything beyond the most basic of necessities. I say it to point out how difficult it is to get a grasp on what greed really means. Most Americans would not think me greedy if I wanted a modest 1,000 square foot home. But even the smallest of homes in the U.S. are luxurious by most world standards simply because they don’t have a dirt floor!

In the same way, it’s easy for me to look at Dave Ramsey’s new house and say “That’s too much!”, but I’m sure my friends in Haiti would consider me quite wealthy to be able to rent the small house I’m in now. I think they’d say the same of Dave Ramsey, but it does cause me to step back and examine myself a bit more closely.

What do you think? Is greed more of the stop-at-nothing-to-get-more definition, or is it closer to the “excessive”-desire-for-more-than-you-need definition? Let me know what you think in the comments at the bottom of the page, but let’s take a look at greed in the Bible.

Greed in the Bible

Checking the dictionary is all fine and well, but I think it’s more helpful to see what the Bible says about greed if we’re trying to look at this from a Christian perspective. Most of what I read online tends to point at the Christian definition of greed as the stop-at-nothing-to-get-more style. I certainly think that’s included, but I wonder if we’re not held to that higher standard.

So I’ve found several verses that discuss greed. Coveting is another way the Bible talks about greed, so I’ve included verses that use either word or concept (like “love of money”). Let’s look at them and see if we can draw a conclusion about the Bible’s definition of greed. I’ll list the verses below and include any additional verses needed to get the context. All verses are from the World English Bible (WEB) version, but if you click the link on the reference you can get just about any version you want.

You shall not covet your neighbor’s house. You shall not covet your neighbor’s wife, nor his male servant, nor his female servant, nor his ox, nor his donkey, nor anything that is your neighbor’s.

Exodus 20:17

Neither shall you covet your neighbor’s wife; neither shall you desire your neighbor’s house, his field, or his male servant, or his female servant, his ox, or his donkey, or anything that is your neighbor’s.

Deuteronomy 5:21

You shall burn the engraved images of their gods with fire. You shall not covet the silver or the gold that is on them, nor take it for yourself, lest you be snared in it; for it is an abomination to Yahweh your God.

Deuteronomy 7:25

20 Achan answered Joshua, and said, “I have truly sinned against Yahweh, the God of Israel, and this is what I have done. 21 When I saw among the spoil a beautiful Babylonian robe, two hundred shekels of silver, and a wedge of gold weighing fifty shekels, then I coveted them and took them. Behold, they are hidden in the ground in the middle of my tent, with the silver under it.”

Joshua 7:20-21

2 In arrogance, the wicked hunt down the weak. They are caught in the schemes that they devise. 3 For the wicked boasts of his heart’s cravings. He blesses the greedy, and condemns Yahweh.

Psalm 10:2-3

17 For in vain is the net spread in the sight of any bird: 18 but these lay wait for their own blood. They lurk secretly for their own lives. 19 So are the ways of everyone who is greedy for gain. It takes away the life of its owners.

Proverbs 1:17-19

He who is greedy for gain troubles his own house, but he who hates bribes will live.

Proverbs 15:27

There are those who covet greedily all day long; but the righteous give and don’t withhold.

Proverbs 21:26

One who is greedy stirs up strife; but one who trusts in Yahweh will prosper.

Proverbs 28:25

Yes, the dogs are greedy, they can never have enough; and these are shepherds who can’t understand: they have all turned to their own way, each one to his gain, from every quarter.

Isaiah 56:11

But your eyes and your heart are not but for your covetousness, and for shedding innocent blood, and for oppression, and for violence, to do it.

Jeremiah 22:17

In you have they taken bribes to shed blood; you have taken interest and increase, and you have greedily gained of your neighbors by oppression, and have forgotten me, says the Lord Yahweh.

Ezekiel 22:12

They covet fields, and seize them; and houses, and take them away: and they oppress a man and his house, even a man and his heritage.

Micah 2:2

21 For from within, out of the hearts of men, proceed evil thoughts, adulteries, sexual sins, murders, thefts, 22 covetings, wickedness, deceit, lustful desires, an evil eye, blasphemy, pride, and foolishness.

Mark 7:21-22

He said to them, “Beware! Keep yourselves from covetousness, for a man’s life doesn’t consist of the abundance of the things which he possesses.”

Luke 12:15

33 I coveted no one’s silver, or gold, or clothing. 34 You yourselves know that these hands served my necessities, and those who were with me.

Acts 20:33-34

For the commandments, “You shall not commit adultery,” “You shall not murder,” “You shall not steal,” “You shall not give false testimony,” “You shall not covet,” and whatever other commandments there are, are all summed up in this saying, namely, “You shall love your neighbor as yourself.”

Romans 13:9

9 I wrote to you in my letter to have no company with sexual sinners; 10 yet not at all meaning with the sexual sinners of this world, or with the covetous and extortioners, or with idolaters; for then you would have to leave the world. 11 But as it is, I wrote to you not to associate with anyone who is called a brother who is a sexual sinner, or covetous, or an idolater, or a slanderer, or a drunkard, or an extortioner. Don’t even eat with such a person.

1 Corinthians 5:9-11

17 This I say therefore, and testify in the Lord, that you no longer walk as the rest of the Gentiles also walk, in the futility of their mind, 18 being darkened in their understanding, alienated from the life of God, because of the ignorance that is in them, because of the hardening of their hearts; 19 who having become callous gave themselves up to lust, to work all uncleanness with greediness.

Ephesians 4:17-19

3 But sexual immorality, and all uncleanness, or covetousness, let it not even be mentioned among you, as becomes saints; 4 nor filthiness, nor foolish talking, nor jesting, which are not appropriate; but rather giving of thanks. 5 Know this for sure, that no sexually immoral person, nor unclean person, nor covetous man, who is an idolater, has any inheritance in the Kingdom of Christ and God.

Ephesians 5:3-5

1 If then you were raised together with Christ, seek the things that are above, where Christ is, seated on the right hand of God. 2 Set your mind on the things that are above, not on the things that are on the earth. 3 For you died, and your life is hidden with Christ in God. 4 When Christ, our life, is revealed, then you will also be revealed with him in glory. 5 Put to death therefore your members which are on the earth: sexual immorality, uncleanness, depraved passion, evil desire, and covetousness, which is idolatry; 6 for which things’ sake the wrath of God comes on the children of disobedience.

Colossians 3:1-6

3 If anyone teaches a different doctrine, and doesn’t consent to sound words, the words of our Lord Jesus Christ, and to the doctrine which is according to godliness, 4 he is conceited, knowing nothing, but obsessed with arguments, disputes, and word battles, from which come envy, strife, insulting, evil suspicions, 5 constant friction of people of corrupt minds and destitute of the truth, who suppose that godliness is a means of gain. Withdraw yourself from such. 6 But godliness with contentment is great gain. 7 For we brought nothing into the world, and we certainly can’t carry anything out. 8 But having food and clothing, we will be content with that. 9 But those who are determined to be rich fall into a temptation and a snare and many foolish and harmful lusts, such as drown men in ruin and destruction. 10 For the love of money is a root of all kinds of evil. Some have been led astray from the faith in their greed, and have pierced themselves through with many sorrows.

1 Timothy 6:3-10

For the overseer must be blameless, as God’s steward; not self-pleasing, not easily angered, not given to wine, not violent, not greedy for dishonest gain;

Titus 1:7

Be free from the love of money, content with such things as you have, for he has said, “I will in no way leave you, neither will I in any way forsake you.”

Hebrews 13:5

1 Where do wars and fightings among you come from? Don’t they come from your pleasures that war in your members? 2 You lust, and don’t have. You kill, covet, and can’t obtain. You fight and make war. You don’t have, because you don’t ask. 3 You ask, and don’t receive, because you ask with wrong motives, so that you may spend it for your pleasures.

James 4:1-3

In covetousness they will exploit you with deceptive words: whose sentence now from of old doesn’t linger, and their destruction will not slumber.

2 Peter 2:3

There’s no doubt that the majority of those verses cover the stop-at-nothing-to-get-more definition of greed. But several of the verses point toward greed as the “excessive”-desire-for-more-than-you-need idea. In particular, Proverbs 21:26, Luke 12:15, and 1 Timothy 6:3-10 all seem to describe greed as being selfish, not being content, and desiring things for the sake of having more (often, more than your neighbor). That certainly fits in with the broader definition – greed as excessively desiring more than you need.

Personally, I think the Gospel of Jesus Christ eliminates any semblance of greed as an option for Christians. If we’re to be focused on loving others and helping the poor, how can we spend our time daydreaming about bigger houses, nicer cars, more exotic vacations, and lazy retirements? That certainly wouldn’t fit the instructions of Colossians 3:1-6.

Your Thoughts

But I want to know what you think. What is greed? What does it mean to be greedy? Is greed limited to the stop-at-nothing-to-get-more definition? Or is it more broad as in the “excessive”-desire-for-more-than-you-need definition? And in that same line of thought, when does a desire for more than you need become excessive and when does it remain acceptable? (That’s a question worthy of it’s own post!)

Let me know what you think in the comments below, and we’ll work through this issue together.

(photo credit: See-ming Lee)

This post was included in the Carnival of Personal Finance.

Good money management isn’t about making all the smartest moves. It’s about avoiding the dumb mistakes. You don’t need the perfect budgeting method, the highest interest rates on your savings, the best investing strategy, or a flawless system for managing your money. Those things certainly won’t hurt you, but they’re not essential for financial success either.

Good money management isn’t about making all the smartest moves. It’s about avoiding the dumb mistakes. You don’t need the perfect budgeting method, the highest interest rates on your savings, the best investing strategy, or a flawless system for managing your money. Those things certainly won’t hurt you, but they’re not essential for financial success either.

Learning to avoid the major pitfalls in personal finance is all you really need to be moderately successful. Getting a hold on the basics of personal finance is enough to get you most of the way there. The advanced stuff only helps you improve your success once you’ve gone as far as the simple stuff can take you. Let’s talk about a few examples so you can see what I’m saying.

Spending

Dumb Mistake: Spending more than you earn.

The Basics: Don’t spend more than you earn!

It’s so simple that it almost sounds stupid, but spending less than you earn (or earning more than you spend…) is by far the most important step in personal finance success. Without it, you’ll be floundering in debt and never getting ahead. But with it, you’ll be well on your way to controlling your money and putting it to work for you.

Savings

Dumb Mistake: Having no savings at all.

The Basics: Keep an appropriate amount in savings for emergencies.

Without some savings in place, you’ll have to rely on credit or gifts to cover your emergencies. High interest rates can crush your financial progress if you don’t repay quickly. And relying on gifts isn’t likely to produce much success if people keep seeing you make poor financial choices – eventually their generosity will dry up. Having access to savings will help you weather hard times and give you the ability to seize good opportunities that come along.

Insurance

Dumb Mistake: Ignoring insurance because you think you can’t afford it.

The Basics: Make sure your major risks (life, disability, home, auto, health) are covered if they need to be.

I’m not a big fan of insurance myself, so I can understand why people tend to ignore it and put it off. It can be confusing and it’s difficult to get objective advice from someone who’s not just out to sell you a policy so they can get a commission. But taking time to learn about insurance, figuring out how much you need (if any), and shopping around for policies will be well worth the reward. Insurance can help protect the financial progress you have made and ensure that setbacks won’t destroy your finances.

Retirement

Dumb Mistake: Saving nothing for retirement and hoping it all just works out.

The Basics: Take a little time to estimate how much income you’ll need for retirement, save the right amount every year, and invest in it in a low-cost, diversified portfolio of index funds with an appropriate asset allocation.

Ignoring retirement because you’re not sure what to do isn’t going to help anything. Too many people wait until 10 years before they want to retire to start thinking about whether they have enough saved or not. That’s just about the dumbest thing you can do in retirement planning because there’s very little you can do at that point without some drastic changes to your life. But a little basic knowledge and small time commitment can help you come up with a plan to save a bit each year for retirement. Revisit that plan every few years and you can approach retirement with more confidence.

Stop Worrying and Get Started!

The basics of personal finance will get you a long way in your journey but not if you don’t start implementing them now. Yes, there’s much more to discuss about personal finance than the few things I’ve laid out here. But these few examples show that just a little basic knowledge will get you most of the way there. You can worry about all the complicated stuff as you get farther along, but if you don’t start using the basics now you’ll never get to a point where the complex stuff even begins to matter.

So stop worrying about whether you’ve got it all figured out yet. If you know the basics, start doing that stuff now. You can improve things as you go along to increase your chances of success, but neglecting the basics will ensure that you’ll never have to worry about all the advance moves you could make in the future. Master the basics and you’ll be fine!

photo credit: (Eric Wüstenhagen on Flickr)

In all my reading about investing (especially online), I’ve noticed a disturbing trend. People tend to talk about investing in terms of their beliefs. One might say, “I don’t believe people can’t beat the market. You can find good stocks by using your brain and analyzing information. I believe in active investing.” Another says, “I don’t believe anyone can beat the market. Most professional fund managers can’t do it consistently, and you probably can’t either. I believe in passive investing.” Still others say, “Market timing doesn’t work. It’s like predicting the future. I don’t believe in trying to time the market.” While some argue, “You CAN time the market if you know how. I believe it is possible to miss the bad days and save yourself a lot of money. I believe in market timing.”

In all my reading about investing (especially online), I’ve noticed a disturbing trend. People tend to talk about investing in terms of their beliefs. One might say, “I don’t believe people can’t beat the market. You can find good stocks by using your brain and analyzing information. I believe in active investing.” Another says, “I don’t believe anyone can beat the market. Most professional fund managers can’t do it consistently, and you probably can’t either. I believe in passive investing.” Still others say, “Market timing doesn’t work. It’s like predicting the future. I don’t believe in trying to time the market.” While some argue, “You CAN time the market if you know how. I believe it is possible to miss the bad days and save yourself a lot of money. I believe in market timing.”

What’s Missing?

You know what’s missing in most of these “belief” statements? Data. Facts. Testable, verifiable information. Knowledge. You don’t often hear people say “I know active investing works.” unless they’re talking about anecdotal evidence. And sadly, you don’t often hear people say “I know passive investing works.” They believe it because someone else believes it. Or because someone else told them to believe it. Or because it just “makes sense”. (This is true of any investment philosophy…)

Check Your Facts

The thing is we have data, albeit historical data, but data nonetheless. We can’t guarantee that the future will look like the past, but we can learn some valuable lessons from it. We can learn that it is absolutely true that most people don’t beat an appropriate market benchmark consistently. (And when I say most people I mean 90%+ and by consistently I mean at least 10+ years in a row.) And we can verify data about market timing by looking at the results of those who try it.

Then we get into the dangerous area of trying to predict the future. We make conjectures about what we think may or may not happen in the future. Then we build up our investment philosophy around that. Too often, we build it only on those conjectures and ignore all the data. And that’s the problem I’m seeing.

Belief or Reality?

I’m not going to get into the details of what we think we know and don’t know. I simply want to ask you to think the next time you talk about your investing “beliefs”. Are you basing your beliefs on facts, data, and information you can test? Or are you basing it completely on feelings, conjectures, and guesses about the future or what makes sense to you?

Photo Credit: (SAN_DRINO on Flickr)

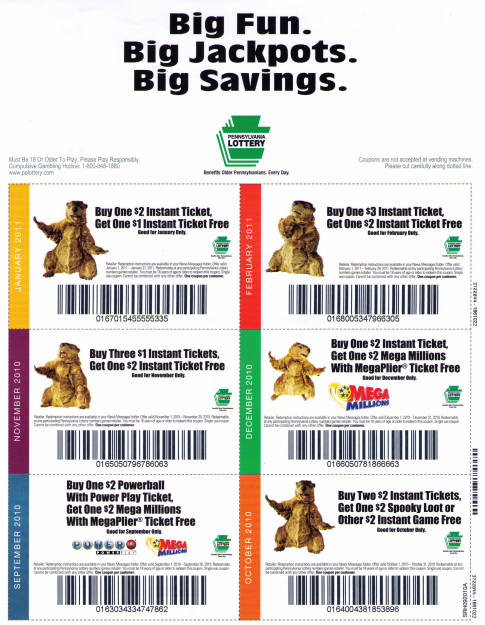

I pulled this out of our mail the other day:

Seriously? Someone at the Pennsylvania Lottery must be playing a joke. Big Savings? Let me get this straight. You’re going to use a coupon to buy a lottery ticket, and that’s going to bring you big savings? Let’s think about this just a bit.

What Are Your Chances of Winning?

Let’s use the September coupon for our example. This coupon gives you one $2 Mega Millions with MegaPlier ticket for free if you buy one $2 Powerball with Power Play ticket. Basically, this is just one set of numbers because a regular ticket costs $1 for one play and the Power Play (or MegaPlier) doubles the cost of the ticket.

The Pennsylvania Lottery’s website says your overall chances of winning a prize with a Powerball ticket are 1 in 35.11.

We can figure out your chances for winning any of the specific prizes with some simple math. If your chances of winning a prize are 1 in 35.11, that means you have a 2.8482% chance ((1/35.11)*100) of winning every time you play Powerball. (Not very good, huh?) Basically, you can only expect to win something once out of every 35 tickets you buy. But that doesn’t tell us how much the ticket is really worth because your prize can range from $3 to $14,000,000 (or $6 to $14,000,000 if you buy the Power Play option) given the current jackpot. To figure out the value of your ticket, we’ll need to do a little more math.

What’s Your Ticket Really Worth?

By using the odds given for each specific prize level, we can figure out the average prize for a winning ticket. Overall, you have a 2.8482% chance to win on any given ticket. You can use the same process to figure out your chances of winning a given prize. For example, the Pennsylvania Lottery website says you have a 1 in 61.73 chance of winning the lowest prize of $3. That’s a 1.61996% chance ((1/61.73)*100) of winning $3 on any given ticket. Since you have a 2.8482% chance of winning any prize, you’d expect a little more than half of your winning tickets to have a $3 prize. (The math is simple: 1.61996/2.8482 = 0.568766 * 100 = 56.8766%.)

Continuing this process for each prize level, we can figure out your chances of winning a specific prize any time you have a winning ticket. This table shows those chances for a regular Powerball winning ticket.

| Match | Prize | Chance of Winning This Prize on a Winning Ticket |

| 5 Numbers + Powerball | Jackpot (currently $14,000,000) | 0.000018% |

| 5 Numbers | $200,000 | 0.0006833% |

| 4 Numbers + Powerball | $10,000 | 0.0048552% |

| 4 Numbers | $100 | 0.1845% |

| 3 Numbers + Powerball | $100 | 0.2573% |

| 3 Numbers | $7 | 9.7787% |

| 2 Numbers + Powerball | $7 | 4.4604% |

| 1 Number + Powerball | $4 | 28.4363% |

| Powerball Only | $3 | 56.8772% |

Now we can figure out the value of a winning ticket simply by multiplying the prize by your chance of getting that prize on any given winner. Doing that tells us that the average winning ticket for regular Powerball is worth $7.65 ($8.65 – $1.00 for playing). Adding the Power Play to the mix changes the prize values, so the average winning ticket for Powerball plus Power Play is worth $24.04 ($26.04 – $2 for playing). (And technically, it would be worth a little less than that because there’s always the chance you might have to split the jackpot with someone else. But I don’t feel like finding the stats on that or doing the math.)

That leads us to the next question. If the average winning ticket is worth $7.65 (or $24.04 for Power Play), then what is the average ticket worth? You only have a 2.8482% chance of winning that $7.65 (or $24.04). We need to take into account the cost of your losing tickets, which you’ll have 97.1518% of the time. Remember, you have to buy 35.11 tickets before you can expect to have a winning ticket (based on the odds). That leaves you with 34.11 losing tickets. If you’re playing regular Powerball, you’ll need to spend (that is, lose) $34.11 to win $7.65. If you’re playing Powerball with Power Play, you’re looking at a cost of $68.22 to win $24.04.

Our last bit of math will tell us the average value of any given ticket. Let’s check regular Powerball first. On average, you’ll spend $34.11 to win $7.65 leaving you with an overall loss of $26.46. Divide that by the total number of tickets you had to buy (35.11) and you’ll find that the average regular Powerball ticket is worth -$0.75. To put it another way, instead of buying a $1 Powerball ticket you might as well throw three quarters in the trash. (Oh wait, I forgot…the Pennsylvania lottery benefits older residents – every day. So maybe you should just donate the three quarters instead.)

What about Powerball plus Power Play? It certainly looks like a more attractive value proposition at first glance since the average winning ticket is worth so much more. On average, you’ll spend $68.22 to win $24.04 leaving you with an overall loss of $44.18. So that means the average Powerball plus Power Play ticket is worth -$1.26. This time, instead of donating three quarters rather than buy a Powerball plus Power Play ticket you should donate five quarters! In terms of absolute dollars, you lose more with Power Play but the % loss is better than regular Powerball. (In regular Powerball, you lose 75% of your money forever. With Power Play, it’s “only” 63%. Granted, it starts looking a little better when the jackpot is very large, but your chances of splitting the prize increase as more people buy tickets. This means the lottery is always going to be a losing bet.)

Let’s put this all into a little perspective. Buying a Powerball lottery ticket would be the equivalent of getting a $10,000 gift, going out into your back yard, and then proceeding to burn $7,500 of it for “fun”. Big Fun – according to the Pennsylvania Lottery.

You Want Big Savings? I’ll Show You Big Savings.

I’m not going to take the time to prove that the lottery (in any form) is a waste of your money. You can simply look at the July 2009 – June 2010 annual income and expense report from the Pennsylvania Lottery to see that they only end up paying out about 61% of their total sales to winners. Talk about a great business! I’d take a 30% net profit margin any day. (The other 9% goes to other expenses.)

Looking at those numbers from the other end, we see that lottery players as a whole are buying something with a guaranteed return of -39%! You want big savings? Here’s a thought. Stop paying the poor people’s tax.

I recently had a friend comment that renting is “throwing away money”. This is a common misconception because home ownership has been touted as the best path to building wealth and a great decision for everyone. But the truth is that renting isn’t really as bad as some would have you think. In fact, it can be the best choice for many people – it all depends on your situation.

I recently had a friend comment that renting is “throwing away money”. This is a common misconception because home ownership has been touted as the best path to building wealth and a great decision for everyone. But the truth is that renting isn’t really as bad as some would have you think. In fact, it can be the best choice for many people – it all depends on your situation. Dave Ramsey is well-known as a proponent of the “

Dave Ramsey is well-known as a proponent of the “