Recently, I had a client ask me for a spreadsheet to help her track her business expenses. I put together an Excel spreadsheet with columns for all the information you need to track business expenses for Schedule C. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. I made all of this general enough so I can use it with other clients, and I thought some of you might find it useful for your own businesses.

Recently, I had a client ask me for a spreadsheet to help her track her business expenses. I put together an Excel spreadsheet with columns for all the information you need to track business expenses for Schedule C. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. I made all of this general enough so I can use it with other clients, and I thought some of you might find it useful for your own businesses.

Before I get into explaining the spreadsheet, let me just add that you’ll still need to have records like receipts and bank statements to back up the expenses you claim. If you want to learn more about recordkeeping requirements, I’d recommend reading IRS Publication 583 and Publication 463.

Free Spreadsheet for Tracking Your Business Expenses

To use the spreadsheet, you’ll need to have Microsoft Excel, Microsoft Office, or Open Office (which is free!). I thought about uploading it to ZohoSheets, but I’m not sure if the conditional formatting will work on there.

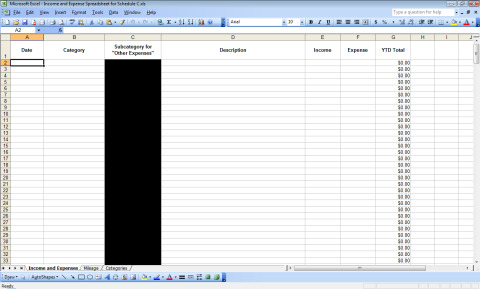

You can download my free spreadsheet for tracking your business expenses by clicking here or on the picture below. (Try right clicking and selecting “Save as…” if it tries to open inside your browser.)

You’ll see three tabs. Ignore the “Categories” tab. I used it simply for formatting the drop down list on the “Income and Expenses” tab. The other two tabs are pretty straightforward. “Income and Expenses” is for tracking…income and expenses. “Mileage” is for mileage.

There are 365 rows in each of the tabs you’ll be using. If you want to add more on the “Income and Expenses” tab, simply highlight the entire last empty row and hit Ctrl+c. Then highlight the rows you’d like to copy it to. From the ‘Edit’ menu select ‘Paste Special’. Be sure ‘All’ is selected, then click ‘OK’. The reason you need to do it this way is so the conditional formatting will be copied over.

Income & Expenses

To track your income and expenses, list each item/transaction separately on the “Income and Expenses” tab. If you buy several different things at a store, group them by category rather than lumping them together. Put the date in column A. Choose a category for each item in column B (according to the definitions below).

If you choose “Other Expenses”, then column C will change from black to white. You’ll then want to type in a subcategory for that item in column C. Try to use the same subcategories for similar items as much as possible and don’t make them too specific (just enough to make it clear what it is) – it will make tax time easier. You can use the other categories as an example for how broad/narrow to make your subcategories.

In column D, enter a more detailed description of the item so you will be able to match it up to a bank statement or receipt if necessary. Finally, enter the total in column E if it’s income or column F if it’s an expense. The final column will update automatically.

Here are descriptions of how you should use each category. It’s long, but it will help you track your expenses in a way that will fit right into your tax return. That will save you time and money, so take a little time to understand these categories.

- Income – Assign this category to all sources of income. Although there are some types of income that would be considered “other income” on Schedule C, you’re likely going to need help from a professional if that’s an issue for you. I’d recommend reading through the instructions for Schedule C (particularly page 4) for more information. Actually, you should read through it anyway.

- Advertising – Include advertising and promotional costs like print or media ads, business cards, mailers, brochures, signs, pens, and give-away items with the company name, samples, or freebies to promote your business in this category. Also, include any sponsorships like buying an ad in a high school sports program to promote your business.

- Car & Truck Expenses – You can deduct actual costs for operating your car or truck in your business, or you can take the standard mileage rate ($0.50/mile in 2010). If you choose to take the standard mileage right (and you’re eligible to do that), then the only thing you’ll include here are your parking fees and tolls. If you want to deduct actual costs, then include the cost of gas, oil, repairs, insurance, depreciation, or your tags here. For most people, it’s simpler and better to just go with the standard mileage rate.

- Commissions & Fees – If you pay any commissions or fees to non-employees, include them here. Things like sales commissions or finder’s fees would be most typical.

- Contract Labor – If you hire a contractor to handle something for your business, put the cost in this category. The key is that they can’t be considered an employee. This depends on the nature of your relationship with the person and relative control over their work. Get advice if you’re not sure how to handle this.

- Depletion – This probably won’t apply to many people. It relates to using natural resources within your business (like timber or minerals).

- Depreciation & Section 179 Expense Deduction – If you buy a major item for your business, you can write off some of the cost each year (depreciation) or write it off all at once (Section 179) with limitations. Keep good records of what you buy and how much business use it gets. This area can also get tricky, so read those instructions for Schedule C and get help if you need it.

- Employee Benefits – This only applies if you hire employees. In that case, you’d include things like health, life, or accident insurance premiums here. You’d also include dependent care, education assistance, adoption assistance, employee rewards, and any other benefits you pay your employees. It would not include benefits for yourself.

- Insurance – This covers insurance for your business and for the operation of your business – not your personal insurance. Examples would be liability, fire, theft, robbery, flood, hail, volcano, etc. Also, note that it doesn’t include your health insurance as that goes under adjustments to income if you’re eligible.

- Interest (Mortgage or Other) – This includes interest on loans to finance your business, credit card interest and fee charges for business expenses, and interest on a loan for property used in your business. Separate it out depending on whether it’s mortgage interest or other (anything else).

- Legal & Professional Services – Fees for tax advice, tax preparation, legal advice, and so on go here. But for tax prep you can only include the cost of preparing the Schedule C, C-EZ, SE, 4562, 8829, and accompanying worksheets because they are directly rated to your business. Your tax preparer can help you figure this out if you use one.

- Office Expenses – This covers office supplies for your business: ink, paper, toner, pens, staplers and staples, paper clips, folders, postage, and so on.

- Pensions & Profit-sharing Plans – This will only apply if you have employees and offer these benefits. If you do, then you should already know what’s required. If not, you need to hire a professional.

- Rent or Lease – You have two choices here. One is for leasing a “vehicle, machinery, equipment” and an option for “other” (like payments for an office rental, rental of other spaces for storage, and anything else that doesn’t fit in the first choice). These can get complicated depending on what you’re renting or leasing. Be sure you know the rules or get help.

- Repairs & Maintenance – This one refers to cost of labor, supplies, and any other items that do not increase the value or life of your business property (stuff you use in the business). So you’d included the cost of fixing something that broke or the costs of maintaining it. If you did it yourself, you cannot pay yourself and then deduct the labor. If you replaced whatever broke with something new, you need to put that under a new purchase – depreciation/section 179 for a big item, office expenses or supplies for a small item.

- Supplies – Use this to cover other small items you use in the business that don’t fit in office expenses. If it’s a higher ticket item or something you’ll use for more than a year, it will need to go in the depreciation/section 179 category.

- Taxes & Licenses – This category includes certain sales taxes, real estate and personal property taxes on business assets, licenses and regulatory fees for your business, the employer’s share of Social Security and Medicare taxes for your employees, federal unemployment taxes, federal highway use taxes, and state unemployment or disability taxes. This can also get complicated so be sure to check on the rules if this applies to your business.

- Travel OR Meals & Entertainment – Travel means you were away for business purposes at least overnight. it could apply to something like a convention, seminar, or visiting a client as long as it’s business related. It can even include cruises if they meet certain requirements (still has to be business related like a conference or something). Meals and Entertainment must have a business related purpose, and entertainment can only count if you’re actually able to get some business done with the client (it can’t be so distracting as to make doing business impossible). There are some other specifics you need to understand before claiming any of these, so definitely read up on the rules here.

- Utilities – You can only deduct utilities directly related to your business. The full cost of a cell phone for business use only or the portion of your cell phone bill attributable to business use would go under this category. Any other utility expenses would also go here (gas, electric, oil, etc.).

- Wages – If you have employees, you’ll put their salaries and wages in this category. Do not include your own wages/salary here. Also, you have to reduce this amount by any employment credits you claim. If you’re going to hire employees, you better know what you’re doing or be ready to hire a professional to help you.

- Other Expenses – Anything that doesn’t fit in one of the above categories goes here. Assign a subcategory that is not too broad or too specific (see any of the others for examples). Items here have to be spent for your business, and they need to be things that are ordinary and necessary (useful) in your particular business. As long as it’s reasonable, you don’t need to worry too much about it. But if you’re going to push the envelope, then make sure you can prove its business use or seek help from a tax professional for verification.

Got all that?! You’ll probably need to read over it a couple times and think about your situation to see what you need to remember the most. If you really get stuck, don’t be afraid to hire a good tax professional for help. It’ll be more than worth the penalties you could face if you’re wrong!

Mileage

Tracking your mileage is a little more straightforward. Enter the starting mileage on your car in cell C1 at the beginning of the year. At the end of the year, you’ll enter the ending mileages. If you use two different cars, keep track of the starting and ending mileages for each car.

Record each trip separately. You can combine round trips into a single entry if you like – just make it clear in the description. Enter the date in column A. Enter the total mileage driven for business purposes in column B. Enter your destination in column C and make it specific enough that you can recalculate the mileage in the future if needed. It’s a good idea to enter the starting point and destination to make this easy.

If you make multiple stops in one trip, I’d separate out each leg of the trip. For instance, you go from your home (where you run your business) to Bob’s house, then from Bob’s house to Susie’s house, and then from Susie’s house back to your home. Assuming Bob and Susie are both clients/customers, I’d do three separate entries:

- Mileage from my home to Bob’s house

- Mileage from Bob’s house to Susie’s house

- Mileage from Susie’s house to my home

It might seem silly, but it will be a better set of records than a single entry that says “home, Bob’s, Susie’s, home”.

Finally, include the business purpose of the trip in column D. It doesn’t need to be extremely detailed, but it needs to be clear enough to show that it’s business related. This will vary depending on your particular business, but it should be pretty simple to figure out. Don’t forget to include trips to pick up supplies for your business. You don’t have to be earning income to count the trip.

Using This Spreadsheet for Your Taxes

By using this spreadsheet to track your income and expenses by category, you’ll make tax time a lot easier (for you or your tax preparer). Easier means less errors, less time, and less money to spend. With a little Excel know-how, you can easily sort your income and expenses by category and quickly come up with the grand totals needed for your tax return (using a copy of your original file, of course…). Keep this spreadsheet along with copies of your bank statements, receipts, and invoices, and you should have easy access to your records if you ever need them.

Business Use of Your Home (Home Office Expenses)

I didn’t cover the expenses you can deduct for the business use of your home (home office expenses) or include it in my spreadsheet. The reason is that this can get complicated and the rules are very specific. In fact, unless the area you use for your business is exclusively used for business, you don’t need to be thinking about taking this deduction. You won’t qualify. If you can take this deduction, you’ll need to read up on Form 8829 and the requirements elsewhere.

Complicated Businesses

If your business is complicated, this free spreadsheet probably won’t work well for you. If you keep an inventory and sell stuff you produce, you’ll need to track cost of goods sold as well. I didn’t include that here because that adds even more complications. It’s not a difficult concept to grasp or item to track, but I just didn’t include it here. You can easily add another tab to track that if you need to.

But honestly, if your business is more than slightly complex, you can really benefit from hiring a tax professional to help you out – at least for the first couple of years. Study your tax returns, read the laws and rules, and you might be able to handle everything yourself. But be sure you really understand it because the penalties can be severe if you try something fishy.

Questions?

If you’ve got any questions, leave them here in the comments and I’ll try to help you. If it’s an insanely complex question, don’t be surprised if I tell you to go hire a professional. And finally, please remember that this is all general advice. Your particular situation could require a different approach and I can’t know that without having all the relevant information.

(photo credit: Crispin Semmens on Flickr)

This article was included in the Best of Money Carnival.

This article was also included in the Festival of Frugality.