Some people think starting a “business” so they can put losses on their tax return is a good way to reduce their taxes. The idea is that you’ll reduce your taxable income, which in turn reduces your taxes and can make you eligible for some credits or deductions that you couldn’t get before. Others think it can be a good way to write off personal expenses as “business” expenses and save some taxes that way.

Some people think starting a “business” so they can put losses on their tax return is a good way to reduce their taxes. The idea is that you’ll reduce your taxable income, which in turn reduces your taxes and can make you eligible for some credits or deductions that you couldn’t get before. Others think it can be a good way to write off personal expenses as “business” expenses and save some taxes that way.

But the IRS caught on to this idea a long time ago and there are specific regulations in the Internal Revenue Code to prevent this kind of abuse. Specifically, section 183 of the code limits the deductions that can be taken when an activity is not being carried on to generate a profit. If the IRS determines that your activity is not being engaged in for a profit, then your allowable deductions will be limited to your gross income from the activity – thus eliminating the opportunity to offset your other income with losses.

This section of the law, called the “hobby loss rule,” can throw a wrench in your business plans if you’re not careful. However, a little knowledge will go a long way in protecting you from breaking this rule accidentally and suffering the tax consequences. Here’s what you need to know.

What Is the Hobby Loss Rule?

If you’re carrying on an activity that isn’t for profit, you cannot use losses from that activity to offset other income you might have. Basically, the IRS will limit the allowable deductions you take against your income from the questionable activity so that you can’t claim a loss.

What’s So Bad about Breaking the Hobby Loss Rule?

If your business is found to be a hobby rather than a legitimate business, several bad things happen. First, your gross income from the business is included as “Hobby Income” which goes above the line and increases your adjusted gross income (AGI). This can have several unfortunate effects like making you ineligible for certain tax credits or phasing out some deductions. It also makes it more difficult to take deductions for your hobby expenses because…

Second, your “business expenses” will not be allowed as business expenses. Since your business is considered a hobby, you have to take the expenses on Schedule A as an itemized deduction just like any other hobby expenses. These are considered miscellaneous deductions, which are subject to a floor of 2% of your AGI. This means you only get to start including the deductions after they exceed 2% of your AGI. Remember how you had to add your gross income above the line? Yeah, this is where it can hurt. Even worse, if your itemized deductions (these hobby expenses plus your other deductions like medical, taxes, charitable, etc.) aren’t more than your standard deduction, then you don’t get any benefit from your expenses at all.

Finally, you’re not allowed to take a loss from your hobby activities. You can only offset all your income. Once you’ve done that, the rest of your hobby expenses are disallowed and cannot be used in future (or past) years. Tough luck.

Who Is Subject to the Hobby Loss Rule?

Nearly every single type of business is subject to the hobby loss rule. If your business is structured as a sole proprietorship (individual using Schedule C), partnership, S corporation, an LLC taxed as any of those, or an estate or trust, then you need to be thinking about the hobby loss rule. The only business structures not subject to the rule are C corporations and LLCs that have elected to be taxed as a C corporation.

So if you’ve started a little informal business on the side to earn some extra income, you need to be aware of the hobby loss rule and how to avoid breaking it.

How Can You Prove That You’re Running the Business to Make a Profit?

There are two ways to prove that your business activity is actually for profit. First, there’s the presumption rule. If your business shows a profit for three out of five consecutive years, the IRS is required to presume that your business is for profit and not just designed to generate losses.

So you can have losses for two years out of five and not have to worry about the hobby loss rule. If the IRS wants to make the case that your business is not for profit even though you meet this presumption rule, then the burden of proof is on them – not you. (And just to complicate things a bit…if your business primarily involves breeding, showing, training or racing horses, then you only need to show a profit in two out of seven years to meet the presumption rule.)

I should add here that it is illegal to manipulate your income or expenses to try to meet the presumption rule. You are required to report all income and all eligible expenses for your business activities. This is something auditors will look for if you are audited and have reported business income on your tax returns. The reason you are required to report everything is because some people falsely report business income in an effort to manipulate their tax refunds (for things like the Earned Income Credit). The IRS doesn’t like this (because it’s illegal!) and specifically looks for people who might try that sort of thing…so just don’t do it. OK?

The second way you can show your business is being run to make a profit is to prove it by the facts and circumstances. This comes in handy if you are honestly trying to make a profit but still end up showing losses in more than two years out of five. Here are the factors the IRS considers when determining whether you’re engaged in the business to make a profit:

- Are you running the business in a way that’s focused on making a profit? If you’re generating losses, have you been trying new methods to make a profit?

- Do you have the knowledge needed to make a profit in this business, or are you working with advisers who have that knowledge?

- Does the time and effort you’re putting into the activity show that you intend to make a profit?

- Do you have assets used in the business that can be expected to increase in value?

- Have you had success at making a profit in similar activities in the past?

- What does the history of your profits and losses look like for this business? Could it be considered suspicious or is it typical for this type of activity? Are the losses from the start-up phase? Are the losses due to circumstances beyond your control?

- Have you made a profit from the activity in some years?

- Do you depend on income from this activity for your finances?

- Is this activity purely for personal pleasure or recreation?

No single factor controls whether your activity is for profit or not. The IRS has to weigh all the objective facts in making a determination, and they can’t make assumptions just because the number of factors showing your activity is not for profit outweighs the number showing it is for profit.

It all comes down to the facts at hand, so the more you can do to show that it’s a legitimate business the less you have to worry about. Things like having a separate bank account, keeping good business records, advertising your business, tweaking your business to improve profitability, and spending a significant amount of time working on the business will all work to your advantage.

Public Service Announcement

If you think you’re getting crafty with the IRS, don’t be so sure of yourself. I can assure you that they’ve seen just about everything by now, and their job is to make sure people are paying all their taxes according to the law. They’re not “out to get you,” but they aren’t going to let you cheat on your taxes either. Don’t try anything fishy, and you don’t need to worry.

And if you’re trying to be honest and just didn’t realize these laws applied, then you might want to consider hiring someone to help you with your taxes. At the very least, you need to sit down with someone knowledgeable in this area so they can help you understand what you should know. The IRS doesn’t take “I didn’t know.” as an excuse. You’re responsible for understanding which tax rules you’re subject to and making sure you pay the taxes you owe. Failing to due so is known as negligence and doesn’t exempt you from penalties and fees.

If you have any questions, let me know in the comments below and I’ll try to help you!

(photo credit: lucyfrench123 on Flickr)

This article was included in the Carnival of Personal Finance.

Dave Ramsey is well-known as a proponent of the “

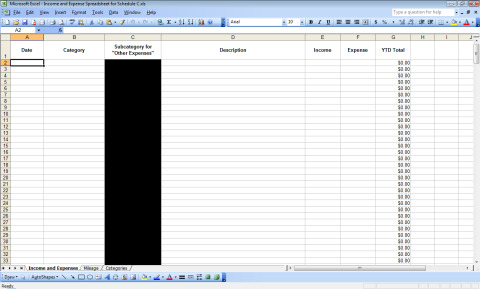

Dave Ramsey is well-known as a proponent of the “ Recently, I had a client ask me for a spreadsheet to help her track her business expenses. I put together an Excel spreadsheet with columns for all the information you need to track business expenses for Schedule C. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. I made all of this general enough so I can use it with other clients, and I thought some of you might find it useful for your own businesses.

Recently, I had a client ask me for a spreadsheet to help her track her business expenses. I put together an Excel spreadsheet with columns for all the information you need to track business expenses for Schedule C. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. I made all of this general enough so I can use it with other clients, and I thought some of you might find it useful for your own businesses.