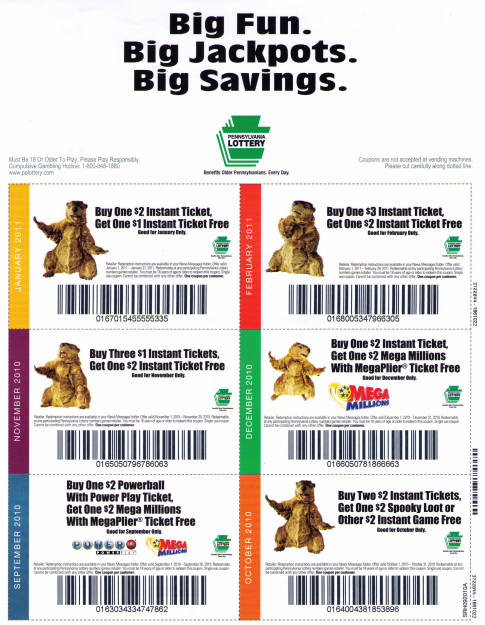

I pulled this out of our mail the other day:

Seriously? Someone at the Pennsylvania Lottery must be playing a joke. Big Savings? Let me get this straight. You’re going to use a coupon to buy a lottery ticket, and that’s going to bring you big savings? Let’s think about this just a bit.

What Are Your Chances of Winning?

Let’s use the September coupon for our example. This coupon gives you one $2 Mega Millions with MegaPlier ticket for free if you buy one $2 Powerball with Power Play ticket. Basically, this is just one set of numbers because a regular ticket costs $1 for one play and the Power Play (or MegaPlier) doubles the cost of the ticket.

The Pennsylvania Lottery’s website says your overall chances of winning a prize with a Powerball ticket are 1 in 35.11.

We can figure out your chances for winning any of the specific prizes with some simple math. If your chances of winning a prize are 1 in 35.11, that means you have a 2.8482% chance ((1/35.11)*100) of winning every time you play Powerball. (Not very good, huh?) Basically, you can only expect to win something once out of every 35 tickets you buy. But that doesn’t tell us how much the ticket is really worth because your prize can range from $3 to $14,000,000 (or $6 to $14,000,000 if you buy the Power Play option) given the current jackpot. To figure out the value of your ticket, we’ll need to do a little more math.

What’s Your Ticket Really Worth?

By using the odds given for each specific prize level, we can figure out the average prize for a winning ticket. Overall, you have a 2.8482% chance to win on any given ticket. You can use the same process to figure out your chances of winning a given prize. For example, the Pennsylvania Lottery website says you have a 1 in 61.73 chance of winning the lowest prize of $3. That’s a 1.61996% chance ((1/61.73)*100) of winning $3 on any given ticket. Since you have a 2.8482% chance of winning any prize, you’d expect a little more than half of your winning tickets to have a $3 prize. (The math is simple: 1.61996/2.8482 = 0.568766 * 100 = 56.8766%.)

Continuing this process for each prize level, we can figure out your chances of winning a specific prize any time you have a winning ticket. This table shows those chances for a regular Powerball winning ticket.

| Match | Prize | Chance of Winning This Prize on a Winning Ticket |

| 5 Numbers + Powerball | Jackpot (currently $14,000,000) | 0.000018% |

| 5 Numbers | $200,000 | 0.0006833% |

| 4 Numbers + Powerball | $10,000 | 0.0048552% |

| 4 Numbers | $100 | 0.1845% |

| 3 Numbers + Powerball | $100 | 0.2573% |

| 3 Numbers | $7 | 9.7787% |

| 2 Numbers + Powerball | $7 | 4.4604% |

| 1 Number + Powerball | $4 | 28.4363% |

| Powerball Only | $3 | 56.8772% |

Now we can figure out the value of a winning ticket simply by multiplying the prize by your chance of getting that prize on any given winner. Doing that tells us that the average winning ticket for regular Powerball is worth $7.65 ($8.65 – $1.00 for playing). Adding the Power Play to the mix changes the prize values, so the average winning ticket for Powerball plus Power Play is worth $24.04 ($26.04 – $2 for playing). (And technically, it would be worth a little less than that because there’s always the chance you might have to split the jackpot with someone else. But I don’t feel like finding the stats on that or doing the math.)

That leads us to the next question. If the average winning ticket is worth $7.65 (or $24.04 for Power Play), then what is the average ticket worth? You only have a 2.8482% chance of winning that $7.65 (or $24.04). We need to take into account the cost of your losing tickets, which you’ll have 97.1518% of the time. Remember, you have to buy 35.11 tickets before you can expect to have a winning ticket (based on the odds). That leaves you with 34.11 losing tickets. If you’re playing regular Powerball, you’ll need to spend (that is, lose) $34.11 to win $7.65. If you’re playing Powerball with Power Play, you’re looking at a cost of $68.22 to win $24.04.

Our last bit of math will tell us the average value of any given ticket. Let’s check regular Powerball first. On average, you’ll spend $34.11 to win $7.65 leaving you with an overall loss of $26.46. Divide that by the total number of tickets you had to buy (35.11) and you’ll find that the average regular Powerball ticket is worth -$0.75. To put it another way, instead of buying a $1 Powerball ticket you might as well throw three quarters in the trash. (Oh wait, I forgot…the Pennsylvania lottery benefits older residents – every day. So maybe you should just donate the three quarters instead.)

What about Powerball plus Power Play? It certainly looks like a more attractive value proposition at first glance since the average winning ticket is worth so much more. On average, you’ll spend $68.22 to win $24.04 leaving you with an overall loss of $44.18. So that means the average Powerball plus Power Play ticket is worth -$1.26. This time, instead of donating three quarters rather than buy a Powerball plus Power Play ticket you should donate five quarters! In terms of absolute dollars, you lose more with Power Play but the % loss is better than regular Powerball. (In regular Powerball, you lose 75% of your money forever. With Power Play, it’s “only” 63%. Granted, it starts looking a little better when the jackpot is very large, but your chances of splitting the prize increase as more people buy tickets. This means the lottery is always going to be a losing bet.)

Let’s put this all into a little perspective. Buying a Powerball lottery ticket would be the equivalent of getting a $10,000 gift, going out into your back yard, and then proceeding to burn $7,500 of it for “fun”. Big Fun – according to the Pennsylvania Lottery.

You Want Big Savings? I’ll Show You Big Savings.

I’m not going to take the time to prove that the lottery (in any form) is a waste of your money. You can simply look at the July 2009 – June 2010 annual income and expense report from the Pennsylvania Lottery to see that they only end up paying out about 61% of their total sales to winners. Talk about a great business! I’d take a 30% net profit margin any day. (The other 9% goes to other expenses.)

Looking at those numbers from the other end, we see that lottery players as a whole are buying something with a guaranteed return of -39%! You want big savings? Here’s a thought. Stop paying the poor people’s tax.